Investing

Why Consider Diamonds as an Investment?

Diamonds are increasingly becoming a more mainstream investment class due to their historical performance, track record of appreciation, and function as a store of generational wealth. Diamonds that hold these characteristics are considered investment-grade diamonds and include two main categories: Fancy Colored Diamonds and D-IF diamonds (the top-end of clear diamonds). These are considered investment grade diamonds, because, in basic economic terms, their supply will never equal demand.

These investment-grade diamonds are increasingly becoming a tool of diversification in smart investors’ portfolios, for a number of reasons that include:

- Privacy: No disclosure of diamond holdings is required in the majority of countries.

- Portability: A multimillion holding of diamonds can be stored and transported in a small envelope.

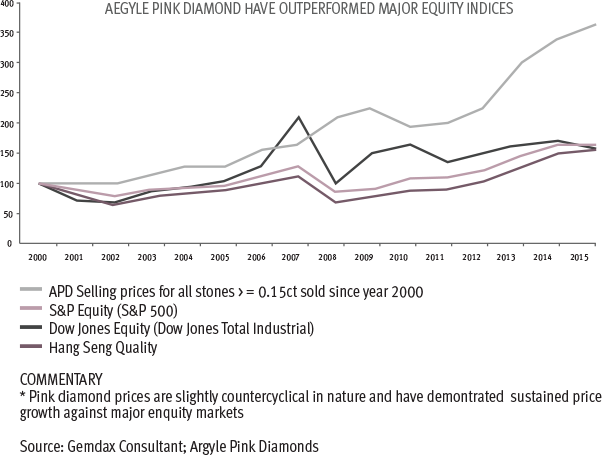

- Stability: Diamond prices have been steadily increasing since the 1970s in a significantly less volatile manner than real estate, the stock market, and gold. Furthermore, during times of recession, investment-grade diamond prices held their value unlike any other conventional asset class.

- Tax: The private sale of diamonds is not taxed in the majority of jurisdictions.

Most investors are not only interested in storing their wealth and keeping up with inflation, but also increasing their wealth in the long-term. Investment grade diamonds have proved themselves as the perfect vehicle for this throughout history.

Some practical examples of price appreciation include:

- A 10-carat Fancy Vivid Blue Diamond was purchased in 1970 for $1 million and sold in 2010 in auction for $15 million, a staggering 1,400% appreciation in price.

- A 10-carat DIF diamond appreciated 400% in the same time period.

- A very rare 24-carat Intense Pink diamond bought in the 1960s for $60,000 was sold in 2010 for $45 million, proving that an investment in a diamond today will provide wealth for many future generations to come.